does fl have real estate tax

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Why are property taxes so high in Florida.

Property Values Are Up So What About Taxes Florida Realtors

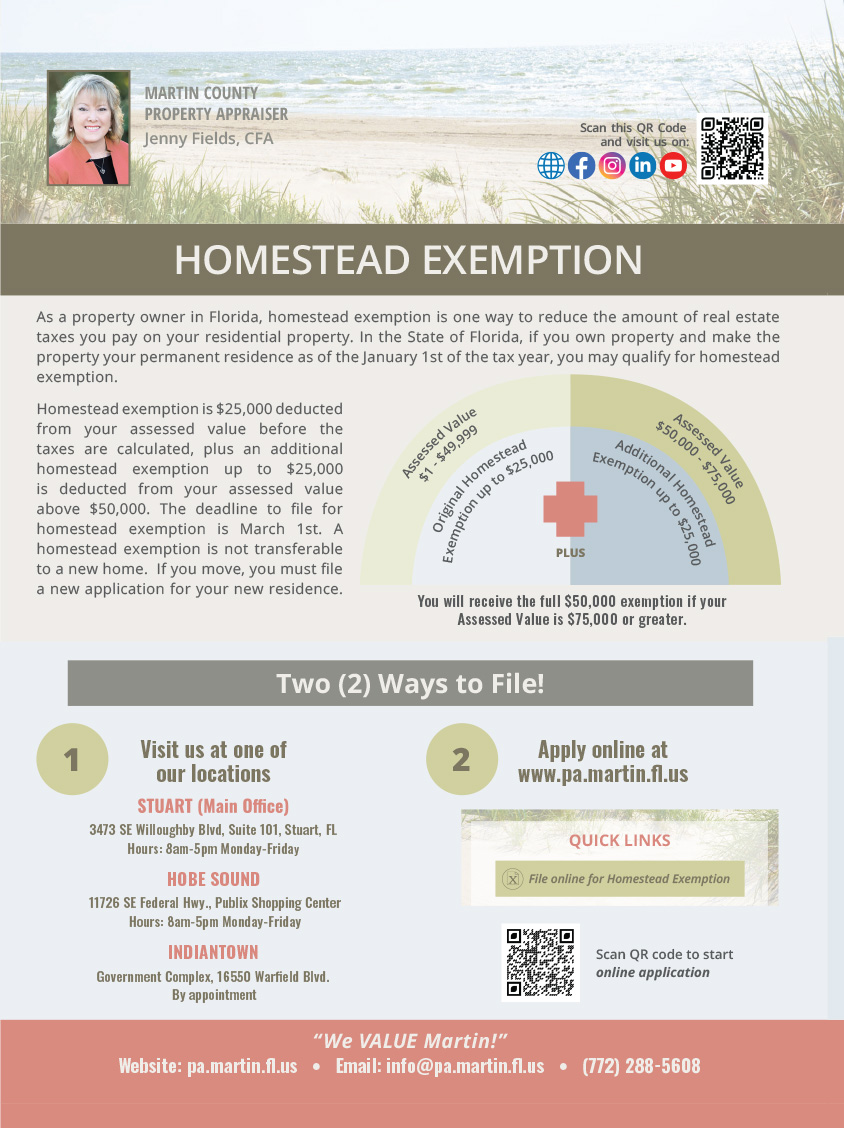

Taxes on each parcel of real property have to be paid in full and at one time except for the installment method and homestead tax deferrals The.

. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Up to 25 cash back Method 1. What taxes do you pay in Florida.

A BIG factor is that none of our retirement money is taxable on the state level and there are NO estate taxes. Discounts are extended for early payment. The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US.

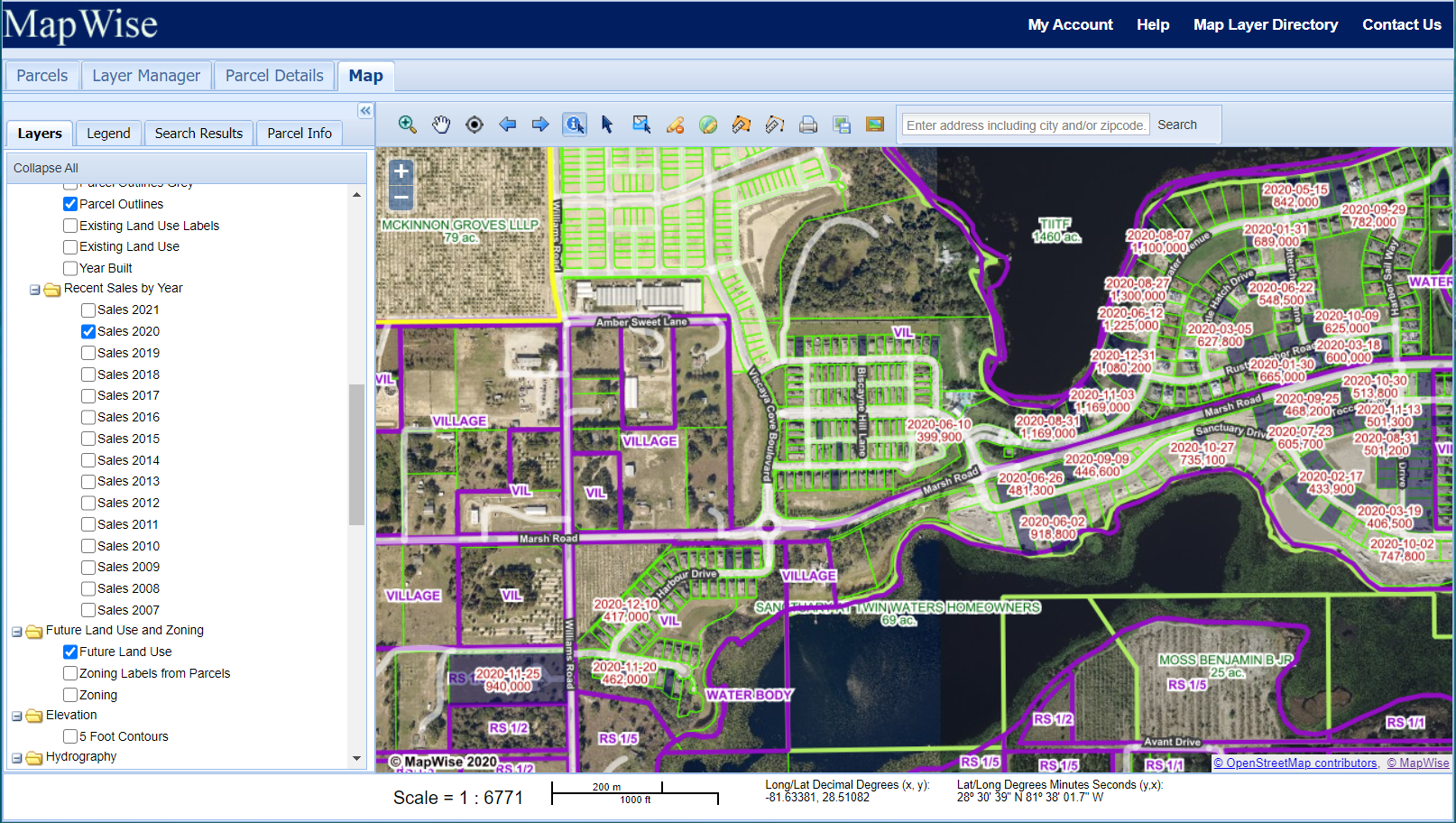

Counties in Florida collect an average of 097 of a propertys assesed fair. Heres an example of how much capital gains tax you might. Each county sets its own tax rate.

Florida property and sales tax support most state and local government funds since the state does not. The first 25000 applies to all property taxes. What this means is that.

Florida does not have a state income tax. Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and. Florida real property tax rates are implemented in millage. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property.

Florida sales tax rate is 6. There is no personal income tax in Florida. Its called the 2 out of 5 year rule.

In Florida homeowners do not have to pay property taxes to the state government. There are also special tax districts such as schools and water management districts that. The state constitution prohibits such a tax though Floridians.

The average property tax rate in Florida is 083. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Appeal the Taxable Value of Your Home.

We have paid as much as 50K in New York state taxes on our tax. Federal Estate Tax. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

Florida authorities compute your property tax by multiplying your homes taxable value by the applicable tax rate. Instead it is the local governments that collect property taxes which serve as their main source of funding.

Calculating State Transfer Taxes In Florida Florida Real Estate Exam Math Tutorial Youtube

What Is Florida County Real Estate Tax Property Tax

Florida Property Taxes Mls Campus

Martin County Property Appraiser Home

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Florida Property Taxes Explained

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

What Is A Florida County Real Property Trim Notice

Florida Property Tax Guide For Homeowners Businesses

Florida County Property Appraiser Search Parcel Maps And Data

The Tax Advantages Of Investing In Florida Real Estate Destin Property Expert

Florida Ranked One Of The Best States In The Country For Taxes South Florida Agent Magazine

Florida Property Tax Calculator Smartasset

Property Taxes By State 2016 Eye On Housing

Florida Real Estate Tax Exemptions What You Need To Know

Flpts Florida Property Tax Solutions

2021 Florida Appeal Deadlines Approaching Firstpointe Advisors Llc